Tuesday, December 1, 2020

'Let's Get It Right' EX3 Network 4

Monday, November 30, 2020

November 2020 Dividend Income: Love Those Midquarters

November has come and gone, the holiday season is officially upon us, and it's time to run through the dividends. Where most investors post their biggest numbers in the quarter end, my time to shine is in the middle of the quarter. I didn't plan for it, that's just the way it played out. It's a little odd, but if Jimmy wants to crack corn, I don't care. In any event, let's get on to the main attraction, shall we?

Publix: $9.18 Same as last quarter but up quite a bit from last year

AT&T (T): $2.27 Up $0.60 due to DRIP and a buy. YoY growth comes to $1.20

AGNC: $0.14 Same as last quarter and down $0.03 from last November

Sprague Resources (SRLP): $9.28 Up $0.36 QoQ due to DRIP and up $1.42 from last year.

Realty Income (O): $1.00 Up a penny from last quarter, but the same as last month.

Hormel (HRL): $0.72 Same as last quarter and up $0.29 YoY.

Kinder Morgan (KMI): $1.39 Up $0.29 from last quarter due to DRIP and a buy; and up $0.38 from last year.

People's United (PBCT): $0.18

Omega Healthcare (OHI): $3.00 Up $0.72 from last quarter and up $0.84 from last year

Proctor & Gamble (PG): $0.82 Up $0.03 from last quarter

Paychex (PAYX): $1.32 Up a penny from last quarter and up $0.04 from last year

Westrock (WRK): $0.83 Same as last quarter

Starbucks (SBUX): $0.01 Probably should have opened with this and closed with SRLP and Publix, but whatever, too late now.

That brings the sub-total to $30.14 Up $3.10 from last quarter and up almost 10 bucks from last year.

The 401K also threw in a bit.

Publix came in with another $2.64, which is up $0.18 from last quarter

The Baird Aggregate Bond Fund added another $0.77, which is the same as last quarter. Combined, the 401K added $3.41 in dividend income.

This brings the grand total to $33.55. I do believe that is a record broken. I'm coming up on the $40 mark, which is pretty crazy. Who knows? I might even crack $50 in the near future.

Interest clocked in at $3.12

No buys in the E-Trade account. I did make some partial share buys over on Robinhood to "bolster" most of the already existing positions, but I don't think that really moved the needle. The 401K got a decent boost, but I don't know if that's enough to warrant a portfolio update at this point. Probably going to wait until the end of the month so that the change can be more apparent. I could change my mind, but we'll see. If the portfolio does get updated, you'll certainly be informed, make no mistake.

Click here to become a Swagbucks member

Click here to become an E-Poll member

Click here to open an E-Trade account

Click here to open a Robin Hood account

Monday, November 16, 2020

'Let's Get it Right' - EX3 Network 3

Sunday, November 1, 2020

October 2020 Dividend Income: Did a Stock Swap. I Swapped Some Stock

We are now in the fourth quarter of the gauntlet that is 2020. Another month has passed and, thus, it is time to look at what treats were received in the form of dividends. So, without further ado, let's get to it.

Pepsi (PEP): $1.08 This is up $0.04 from last quarter and up $0.12 from last year due to DRIP and partial share buys in Robinhood.

Vanguard Total Market Index (VTI): $0.05

Vanguard S&P 500 Index (VOO): $0.04

Vanguard REIT Fund (VNQ): $0.05 Even the tiny positions I initiated in Robinhood are already bearing fruit. It's nice to see, and oddly motivating.

Iron Mountain (IRM): $3.33 Up $0.08 from last quarter due to DRIP and up $1.46 YoY.

AGNC: $0.14 Same as last quarter.

Franklin Resources (BEN): $2.26 Up $0.30 QoQ and up $0.95 YoY

Leggett &Platt (LEG): $0.40 Same as last quarter

Realty Income (O): $1.00 Up $0.02 from last quarter and up $0.01 from last month due to DRIP and a dividend increase. It is nice to finally break that one dollar barrier, need more positions to do that.

Best Buy (BBY): $3.91 Up $0.03 from last quarter

Armanino Foods (AMNF): $0.19 same as last quarter.

This brings the sub-total to $12.45, up $0.61 from last quarter and up $6.48 from last year. It's odd because so many of these are tiny positions that are basically just throwing change. Pepsi and Realty did OK, but Franklin, Iron Mountain, and Best Buy really carried the brunt of that total.

The 401K threw in an extra $0.71, which is (again) down a couple of cents QoQ. It's not devastating now, but I'd still like to see that trend reverse and start going back in the right direction.

Interest also threw in a bit, clocking in $3.77. This is also down due to repeated interest rate cuts, very annoying.

Oddly enough, here's where the real meat of the article comes, because this was a pretty active month for me. To start, I sold off my shares of Diversified Healthcare Trust (DHC) and Howmet (HWM). Those dividends were basically useless, so I redirected that into a share of Kinder Morgan (KMI). That one share pays more than the two prior companies combined, plus it thinned the list down a bit..temporarily.

This prompted me to sell all but one share of Tanger (SKT), Bloomin' Brands (BLMN), and Bed Bath and Beyond (BBBY). I hope they reinstate their dividends at some point. When they do, I'll rebuild those positions but I didn't see much sense in holding on to shares that weren't doing anything. Credit where it's due, though, I bought BBBY at about $8 and sold it at $25. That was a pretty good return and I think the first sale I made for a profit.

This gave me some money to play with so I bought a share of Phizer (PFE), Coca-Cola (KO), People's United (PBCT), Exxon Mobil (XOM), and another share of AT&T (T). I tried to add another share of SJW, but they wouldn't take the order for some reason. It was bizarre.

Over on Robinhood, I also made some small moves. I added partial shares of two more Vanguard ETF's to the portfolio. The first was the dividend appreciation index (VIG), I think that this will complement VYM rather nicely, and a Vanguard utilities ETF (VPU). Partial shares of Dunkin (DNKN), Starbucks (SBUX), Campbell's (CPB), AT&T (T), Target (TGT), McDonald's (MCD), VTI, ConEd (ED), Proctor Gamble (PG), and Pepsi (PEP) were also purchased. This being Robinhood, these buys were all only a dollar or two a pop; so while it looks like a lot, it wasn't that much in terms of capital deployed. In fact, some of the numbers as far as share count didn't even budge, which was jarring, but I suppose that's a cue to do more than just a buck on buys. The portfolio has been updated accordingly. It's a little sad to see so many 1 share positions again, but over time that should remedy itself.

All in all, this was an OK month. I am looking forward to seeing what effect the buys will have going forward and hopefully I can keep the pace going not just for the closing months of 2020, but also through the next year to make it more notable.

Click here to start an account with E-Trade

Click here to open a Robinhood account

Click here to become a Swagbucks member

Click here to become an E-Poll member

Friday, October 30, 2020

Universal Basic Investing?

I came across a tweet yesterday from one Doug Boneparth suggesting that rather than do Universal Basic Income (you know, the $1,000 a month for everyone no questions asked) the government take that and invest it into the S&P 500 in everyone's name with the caveat that they can't touch it for 15 years.

Leftist anti-investing Twitter did not take too kindly to this suggestion. To be fair, it doesn't really work as a response to the more immediate and pressing concerns (or maybe it does, I'll get to that a bit later.) In the long term, though, this (much like ForeverDonor, a site that we still need to figure out how to revive) could be a real game changer.

One of the biggest criticisms in regards to investing is that the gains in the market are only felt by a few people. Even if you are a small time investor (like I am) you don't see the sort of gains that those at the top see. This gets everybody in so that the rising tide would lift all boats in a much more noticeable way.

As far as combating wealth/income inequality, this would go a long way towards achieving the goal. It would also drastically speed up the timetable for eliminating poverty.

There are some things that require clarification. I'm guessing that the money would go into some kind of index fund or ETF (like Vanguard's VOO for example). I guess the money could be allocated to all of the individual companies, but that seems like it would require a lot more work and effort. On the other hand, going the latter route would make for more dividend payout dates.

Yeah, oddly enough, neither side brought up the passive income that this would generate. Now, VOO does pay a quarterly dividend, and $1,000 a month into that would generate quite a bit of momentum. It would create the rising income floor that UBI advocates always say that they want to create. What's really cool, though, is that the government expense doesn't budge. Even if it stays at $1,000 a month, the person's dividend income would still go up due to more shares being possessed. Add in dividend increases and possible dividend reinvestment and good night, Irene.

I'm not sure whether DRIP would be the way to go here. On the one hand, it compounds the compounding effect, on the other hand, people do need the cash now. What would be really cool was if you had the option to do both and ration it out as you needed it. 50/50 would be the most obvious way to go, but different people have different financial needs, so maybe somebody takes those dividends and puts it towards another expense, who knows?

As with any massive government expenditure, one must point out that the government is beyond broke. Seriously, that is one of the worst balance sheets in the history of time. One can't be faulted for raising the legitimate question of how this gets paid for. On the other hand, the government seems happy to pump large quantities of money into the market already, so we might as well see some tangible benefit to that. It beats hearing about multi-trillion dollar stimulus bills that seem to wear off two days later.

Here's another cool thing to take into account. In order to become a millionaire in 15 years, you need to invest $2,850 a month into the market. This does a third of the work for you. More millionaires means more funding for the things and less reliance on government. Again, it generates tax revenue whilst decreasing financial obligations. It's win/win.

Better yet, when something big does come up, people'll be better equipped to deal with it. This would set us up to get ahead of things as opposed to being on our back foot all the time.

People scoffed at the idea, but I don't think it should be so quickly dismissed. There's a lot to like here. I might actually have to go and amend my budget surplus amendment to incorporate this into the equation because it's winning me over the more I think about it.

Sunday, October 11, 2020

Let's Get It Right' - EX3 Network 2

Sunday, October 4, 2020

Robinhood Review

I've been using Robinhood for a little while now and I figured it was as good a time as any to weigh in and give my thoughts on it. There are upsides and downsides, so we'll look at both to see if this is something that you should consider looking into.

Let's get the bad out of the way, and that's the layout. Other reviews have raved about it. The only thing I can think is that it was designed to be used on a phone and I'm using a laptop. I'm getting used to it, but I'm still not crazy about it. Personally, I think E-Trade's layout is better. It's smoother, easier to navigate, and it gives you more information.

On a similar note, the information you want to see is crammed into these little sidebars that the screen cuts off. Even your portfolio itself is relegated to such a section. It's hard to imagine trying to monitor and manage a larger account in that little box.

For the dividend investor, Robinhood doesn't give you an estimated projected forward income the way E-Trade does. I guess you can do that yourself, but having it is still preferable. The site will give you a couple of days notice before you get your dividend, which does makes for a nice surprise when it pops up, but you'd still be operating on the fly.

Don't worry, there are upsides. The first is the free stock. Now, I've only gotten the one share from using a referral link, but there is potential to get more later on down the line. Even so, the one share was a good way to get the ball rolling. Sure, the stock wasn't impressive, but I was able to sell it and get something that better suited my portfolio. It does make you wait three days to do that for some reason. It bugged me when I first started, but it's a moot point now. Still thought it was worth mentioning for those who are looking to do that or to "stock bank".

The other major pro is the partial share buys. I am loving this. Being able to put a couple of dollars into companies that are more expensive is huge. Not only can I initiate positions that I otherwise wouldn't be able to afford, but I can make moves more frequently and get that snowball rolling just a little bit quicker.

So, is Robinhood worth using? That depends. I wouldn't suggest using it as a primary account, but if you're looking to get started, this allows you to get your feet wet and learn the ropes before setting yourself up with another brokerage. If your current broker doesn't allow partial share buys, than this also works as a good supplemental broker.

Click here to open a Robinhood account

Click here to open an E-Trade account

Wednesday, September 30, 2020

September 2020 Dividend Income: En Vanguard

Debates may be dumpster fires, but dividends are money, both literally and figuratively. Yes, with September coming to a close, it's time to log the income that dividends brought in. Where most investing bloggers shine in the quarter enders, mine are usually the weakest. It's especially jarring after the mid-quarter month. Nevertheless, we move forward and progress where we can when we can. In that spirit, let's get on to the numbers.

Kroger (KR): $1.12 Up $0.13 from last quarter due to DRIP and, I believe a dividend increase.

SJW Group (SJW): $0.32 Same as last quarter

Johnson and Johnson (JNJ): $0.03 It didn't take long for the RobinHood buys to start making an impact. I'm not complaining, though.

AGNC: $0.14 Same as last quarter

Emerson (EMR): $0.04

CenturyLink (CTL): $0.28 Same as last quarter

Flowers Foods (FLO): $1.05 Up a penny from last quarter

Walgreen's Boots Alliance (WBA): $0.47 Up a penny

3M (MMM): $0.04

Realty Income (O): $0.99 Up a penny from last quarter and the same as last month

Wendy's (WEN): $0.36 Same as last quarter

McDonald's (MCD): 0.03 Seriously, those Robinhood buys were a game changer. Not only do I have two rival fast food companies paying me dividends in the same month, but they pay on the same day.

VF Corp (VFC): $0.49 Same as last quarter

Vanguard High Dividend Yield ETF (VYM): $0.07

That brings the grand total to $5.43, up $0.37 from last quarter, but down $1.84 from last year.

Meanwhile, over in the 401K, two funds paid. The Baird Aggregate Bond Fund paid $0.77 and the DFA Small Cap Fund paid $0.43. The total for that account clocks in at $1.20.

All in all, the grand total comes to $6.63. This is up $0.31 from last quarter, but down $1.39 from last year.

Interest clocked in at $4.54

This was a pretty active month for me on the buying front, with moves made in both the E-Trade and RobinHood accounts. Over with the primary broker, I averaged down via single share purchases of AT&T (T), VF Corp (VFC), Omega Healthcare (OHI), Franklin Resources (BEN), and Walgreen's Boots Alliance (WBA.

Over in the RobinHood account, I focused my attention on Vanguard ETF's. These are similar to mutual funds, in that they are comprised of a multitude of companies, but they are a bit easier to deal with. I made partial share micro-buys into the Vanguard Total Market Index (VTI), the Vanguard High Dividend Yield ETF (VYM) which has already paid me a dividend as you saw above, the Vanguard S&P 500 Index (VOO), and a Vanguard REIT ETF (VNQ). I also made some $1-2 buys into the already established positions just to give it a nice boost. I may continue doing that going forward. It won't be a game changer, but it will make for steady progress. Considering how many of those pay in the quarter ender, it also gives this block a chance of catching up in the future.

Despite all the action, I haven't gotten around to updating the portfolio post yet. Could be done this weekend or I could just wait until the end of October. I'll have to see how things play out.

All in all, this month was a mixed bag. It was odd in that the quarterly numbers were all steady. Most stayed even, but there were some that went up; despite this the YoY numbers were down. I guess it was only a matter of time before those cuts caught up to me. The QoQ growth kind of tricks you, though. Hopefully, with the buys, I'll be able to recoup those losses and get the numbers going back in the right direction.

We're in the home stretch of 2020. It's been a gauntlet, to be sure, but you just have to put your head down and plow through.

Click here to open an E-Trade account

Click here to open a RobinHood account

Click here to become a Swagbucks member

Click here to become an E-Poll member

Sunday, September 27, 2020

Saturday, September 26, 2020

What Should Bruce Wayne Be Doing With His Money?

Some time ago, I saw a tweet that posited that if Bruce Wayne merely funded a universal basic income, he could eliminate crime in Gotham City in one foul swoop. It's the latest instance in the effort to paint his efforts as the Dark Knight as superfluous and even hedonistic.

Now, to be fair, as far as UBI is concerned, there is some truth to it. There would be a lot fewer "Joe Chill" style criminals roaming the streets and preying on the citizens. The thing is that a vast majority of the crime in the city ISN'T poverty driven. The organized crime rings are very well funded and even the rogues gallery aren't strapped for cash either. Though many of them are depicted robbing places, they're not poor. Penguin is very well to do, Victor Fries was a scientist, Two-Face was a district attorney. And I'm sorry, but giving the Joker $1,000 a month seems like a terrible idea, but that's just me.

Be that as it may, there may be ways for Bruce to put his vast resources to better use. In order to determine whether or not that's the case, we have to look at what he's currently doing with his money.

First and foremost, there is his business, Wayne Enterprises. While it may not be the economic backbone that LuthorCorp is said to be for Metropolis and/or Smallville, it is a power player, creating a lot of jobs in Gotham. These aren't dead-end "McJobs" either, but well paying career type positions. This is a good thing on several fronts.

Bruce also does quite a bit of charity. He doesn't "horde" his wealth, rather tries to channel it to help. He has the Wayne Foundation, but is also frequently shown attending events to raise money for various causes. Now, a cynical reader might just say that this is part of him playing a character so as not to draw suspicion. The thing is that Bruce would still use this as a means of addressing issues and solving problems. Even in his darker portrayals, that was still a main motivator for him.

The third thing, and it's almost galling that so many gloss over this, but he also FUNDS THE FREAKING JUSTICE LEAGUE!!! In every iteration it's Bruce who provides the resources to let the League do what it does best and protect Earth. Taxes can be effectively allocated and improve things on some levels, but there's no way that Bruce paying more would allow Earth to better protect itself from the likes of Darkseid, Brainiac, or the White Martians.

So, while we've established that the accusation that Bruce Wayne isn't doing enough is laughable. There could still be some room for improvement. I mean, Goku didn't just sit back and rest on his laurels after hitting Super Saiyan, right?

One thing that comes to mind is a new asylum in Gotham. Arkham is an iconic piece of the Batman lore, but it kind of....sucks? It's great for atmosphere, but the security isn't very good, it's run down, and the treatment success rate aspires to shoddy. Having the Joker be beyond therapy is one thing but you'd think Harvey Dent, Edward Nygma, or Jervis Tetch would be able to see some sort or sign of rehabilitation at some point.

Arkham itself is most likely a historical landmark so having it renovated would mean a lot of red tape that Bruce would likely not want to bother with. As such, a new asylum would be the best way to go. He can put in top of the line security measures to keep the more dangerous inmates in, whilst also hiring better therapists to treat those inside.

Another thing Bruce can do is ForeverDonor. Now, the Wallet Squirrel guys don't exist in the DCU and the site (unfortunately) doesn't exist in ours either (for now?) Still, Bruce knows the power of passive, compounding income. It's not that much of a stretch for him to come up with the idea himself and use his company and personal resources to build a site that acts in the same capacity.

One advantage that Bruce has is that he regularly rubs shoulders with the high society types. It wouldn't be that hard for him to coax some of his wealthy compatriots to set up accounts to get the snowball rolling. Heck, even Lex Luthor might set up an account to help usher in that bright new age for humanity that he's always going on about. The fact that it's all automatic means that it's something that Bruce wouldn't have to divert any attention towards. Just set up the site and his own account, move some money there and then the problems start to solve themselves.

Beyond that, maybe zero in on crowdfunding? It would be a great way to get that "trickle up" effect going, paying off people's student loans or helping people with medical bills. This also generates tax revenue to boot. He might not be able to fund all of the projects the way that Tony Stark did for that group of MIT students in "Civil War", but it would still help people and create a potential ripple effect as time goes on.

So, there you go. It turns out that Bruce being a primary defender of the planet, does use his resources well. There's room for improvement, but he doesn't deserve the bashing that he seems to be getting lately. If anything, our billionaires need to try to be more like him and jump the bars that he's set.

Sunday, September 13, 2020

'Let's Get It Right' - Flavor of the Week

Tuesday, September 1, 2020

August 2020 Dividend Income: Just the Tip

Another month is in the books, which means that it's time to tally up the dividends. The mid-quarters are my bigger month, which means that there's a lot to cover. As such, let's get right to it.

AT&T (T): $1.67 Up $0.03 from last quarter and up $0.62 from last year.

Publix: $9.18 Same as last quarter

Sprague Resources (SRLP): $8.92 Up $0.41 from last quarter and up $5.21 from last year.

AGNC: $0.14 Up a penny from last quarter, down $0.02 from year, the same as last month

Omega Healthcare (OHI): $2.28 Up $0.05 from last quarter and up $0.21 from last year.

Realty Income (O): $0.99 Up $0.02 from last quarter, Up $0.29 from last year, and up a penny from last month.

Hormel (HRL): $0.72 Up a penny from last quarter, Up $0.29 from last year.

Kinder Morgan (KMI): $1.10 Up a penny from last quarter and up $0.35 from last year.

Proctor & Gamble (PG): $0.79

Diversified Healthcare Trust (DHC): $0.01. Same as last quarter and down $0.14 from last year

Westrock (WRK): $0.83 Up a penny from last quarter, but down $0.08 from last year due to the recent cut.

Paychex (PAYX): $1.31 Up a penny from last quarter and up $0.04 from last year

That brings the total to $27.94, which is down $0.16 from last quarter, but up $12.25 from last year. The prior stat isn't unsurprising given that Tanger is sitting this one out. Actually, the damage wasn't that bad. It looks like DRIP soaked up most of the loss.

Of course, there's also the 401K to consider. Publix shares in that account brought in $2.46 (up $0.27 QoQ), while another fund brought in $0.77 (down $0.05 QoQ.) That sub-total comes to $3.23.

That brings the grand total to $31.17. Beat last quarter's record by $0.04, score. Considering no Tanger and the fact that this quarter hasn't been that active, I'm legitimately surprised by that, but I'll still take the win. 2020 needs all the wins it can get.

Interest came in at $4.76, which is up $0.40 from last month.

I took a different approach with investing this month. I put the fractional share buying ability of RobinHood to good use by investing tips from the second job. This was money that used to go towards the vending machine (which, to be fair, is a Pepsi machine, so it still fueled dividend growth) or just food in general. This time around it went to parts of shares of Johnson & Johnson (JNJ), Emerson (EMR), Target (TGT), Pepsi (PEP), AT&T (T), ConEd (ED), McDonald's (MCD), and Proctor & Gamble (PG). Some of these are new positions, while some of these are companies that I already owned in my first brokerage account. How big of a fraction of a share did I get from each of these? Well, you'll have to check out the newly updated portfolio for that. Those decimals are kind of a pain.

All in all, this was a solid month. I'm hoping Tanger can get back into it, but at least for now,the line is holding. We're coming up on the final stretch of 2020. Time to start getting momentum going so that 2021 can start off on the right foot.

Click here to become a Swagbucks member

Click here to begin investing on E-Trade

Click here to begin investing on RobinHood

Click here to become an E-Poll member

Tuesday, August 25, 2020

Investing and the Creative

You don't want to work, you want to bang on the drum all day. Or maybe you want to write that novel or comic. Maybe you want to make movies, or music, or host a podcast. Alas, life costs money, which means you probably need some sort of day job, which takes time and energy away from the aforementioned projects that you'd likely rather focus on.

This is where dividend income can really come in handy. Money that comes in regardless of hours worked facilitates artistic projects. You can use it to cover life expenses so that you can do your thing full time or keep the job and use the money to cover the more direct costs of whatever passion it is you want to pursue and use it more as "start up capital".

In a way you're giving yourself corporate sponsorship. You know how shows always have that bit where a voice says over a promotional image for the show, "this program is brought to you in part by" and then an ad for some product plays? The same would apply to some extent to whatever it is you're doing. Think of these companies like patrons for your particular art.

This is another reason why it's so important to start young. If you're in high school and working your first job, get those IRA's (both Roth and traditional) up and running, of course,but also start building that portfolio of strong dividend payers. Even if you pause during the college years to cover those costs, reinvesting those dividends will keep building that floor for you. By graduation, you'll be moderately well on your way to the financially independent lifestyle. That'll make it easier for you to get started on that project that has been on the back burner.

UBI has been making the news, and it is uncanny how similar the rhetoric is between those who advocate for the policy and the FI(RE) community; but who knows when, or even if, that comes to pass. The government's numbers aren't exactly strong at the moment and pointing advocates to alternate means of accomplishing the goal hasn't worked as well as one would hope. Even if it was implemented, I wouldn't suggest relying on that alone. Use it to get you to where you want to be faster, sure, but don't just bank on that.

Crowdfunding is also an option, but there's no guarantee there. There are successful Indiegogo and Patreon campaigns, of course, but the odds aren't in your favor. I've made more progress building an income floor in two years investing than I did after 8 years of having a page set up on the latter site. Even poking prominent "I have too much money and I want to give it to you, but Republicans won't let me" figures doesn't seem to work. Contrary to what you may have heard, Bernie won't give it to ya, the Patriotic Millionaires won't give it to ya, even X won't give it to ya (shame on you if you didn't see that coming.)

So, for the aspiring writer, actor, painter etc. this is definitely something you'll want to look into. It's a more indirect way of making a living doing what you want, but it is still very much viable. It isn't like flipping a light switch, but you can definitely start building that momentum and getting the ball rolling.

Click here to start investing on E-Trade

Click here to start investing on Robinhood. This link gets both of us a free share of stock and the site allows fractional share buys, which is great for new investors or those on a tighter budget.

Sunday, August 23, 2020

Let's Get It Right' - Juice & Mantz

Saturday, August 1, 2020

July 2020 Dividend Income: Merry Man

Pepsi (PEP): $1.04 Up $0.07 from last quarter due to DRIP and a dividend increase

Iron Mountain (IRM): $3.25 Up $1.28 due to new share buys and DRIP and up $1.42 from last year.

AGNC: $0.14 Down $0.04 from last quarter and down $0.02 from last year. Same as last month

Realty Income (O): $0.98 Up a penny from last quarter and the same as last month

Leggett & Platt (LEG): $0.40

Best Buy (BBY): $3.88 Up $0.03 from last quarter and up $0.38 from last year

Armanino Foods (AMNF): $0.19 down $0.11 due to a dividend cut

Franklin Resources (BEN): $1.96 Up $0.03 from last quarter and up $1.44 from last year

This brings the total to $11.84, which is up $0.97 from last quarter and up $4.85 from last year. That's actually not too shabby percentage wise.

The 401K threw in another $0.73, a little less than it did last quarter (3 cents less to be exact), but up $0.29 from last year.

Grand total comes to $12.57, which is up $0.94 QoQ and up $5.16 YoY.

Interest clocked in at $4.36, which is up $0.63 from last month.

Technically, there weren't any real buys this month. I did open an account on RobinHood, though. Because I used a referral link I (as well as the person who's link I used, assuming they didn't hit their limit) got a free share of stock. Now, the site boasts that it could be some big name company like Facebook or Microsoft, but odds are that it'll be some dinky $3-7 no name stock. The one I got didn't even pay a dividend, so I sold that and took the whopping $4 and put it into 3M (MMM).

This is another perk of RobinHood, fractional share buys. Even though the stock price of the company is a lot higher than $4, I was still able to initiate a position. Suffice it to say, I plan on putting this to good use in the months and years to come. A couple of other brokerage firms also offer it, but RobinHood is one of the more well known options when it comes to this perk. It's the other reason I decided to go ahead and set up the account.

All in all, July was pretty uneventful. Yeah, the Armanino cut was unfortunate, but reinvested dividends were able to cover that loss. The slow and steady growth continues, which given the chaos is a welcome development.

I'm hoping that August will have a bit more momentum. On the one hand, it is a mid-quarter month and those are usually my strongest months, but with 2020 being 2020, who knows what's going to happen? Still, as the saying goes, always forward.

"stock dividend" by CreditDebitPro is licensed under CC BY 2.0

Click here to open a RobinHood account

Click here to become a Swagbucks member

Click here to begin your own investing journey on E-Trade

Click here to become an E-Poll member

Monday, July 27, 2020

Wallet Friendly Stocks

However, if you start to do some digging, you'll start to see that not every company stock has such a lofty price tag. There are plenty of companies out there with share prices that are much more friendly to the working class. Now, a low price tag can be a warning sign that the company is in dire straits; this is true, but smaller companies can have a lower price tag and still deliver strong returns. I thought it would be a good idea to throw some names out there to get people started.

Now, I should note that these aren't "picks" in the traditional sense. I'm still a relative rookie and there are plenty of other bloggers who are much more well versed in the mechanics. These are, however, stocks that I own and have worked out in my favor so far. Could things change? Of course, especially in this environment, but they've held up pretty well so far despite the headwinds. In any event, let's get to them.

1. Flowers Foods (FLO)

At $22 bucks a share as of this writing, this company is a very easy buy. They make and deliver a variety of breads. I see their crates in my store all the time. Not only is the stock higher than where I bought it, but I've seen a couple of dividend increases since I first bought in. Even in the age of Corona, the payments have held steady, which is always a welcome sign.

2. Franklin Resources (BEN)

Another company who's stock is currently sitting in the low $20 area. They offer financial services and are a dividend aristocrat. While the pandemic is unlike other bouts of economic turbulence, the record gives investors a degree of confidence that they are built to withstand such things.

3. Wendy's (WEN)

For such a big name, this stock is in the same range as the two companies listed above. It's surprising to some extent, but if jimmy wants to crack corn, I don't care. They did recently cut their dividend due to Corona based challenges, but they were one of the stronger raisers before the madness started. In any event, the stock price is higher than when I bought it, so it still seems like a strong buy in my neophyte opinion.

4. Kroger (KR)

At $35 a share at the time of this writing, this company is a little bit more expensive, but still very much attainable. Not only has Kroger held up, but it seems to have thrived in the new age we live in. Grocery stores are critical, so it makes sense. Not only have they kept their dividend increase streak alive, but the stock is higher than it was when I bought it. Growth is always good.

5. AT&T

This one has been very popular among the DGI community as of late. This dividend aristocrat sits at around $30 a share. They not only have a long record of increases, but also a pretty strong yield to go with it.

So, there you go. 5 companies may not seem like much, but it's enough to get the ball rolling on a new portfolio for the rookie investor on a budget. Not only that, but reinvested dividends have that much more power as they get you more fractional shares to get that snowball rolling.

Wednesday, July 22, 2020

'Let's Get It Right' - Reopening America

Monday, July 20, 2020

'JLA' Volume 3: 'Rock of Ages'

Pros

- Story with epic scope

- Very well written Lex Luthor: cunning, charming, and humanity focused. While his conflict expands to the League, his focus is still squarely on Superman

- While he's a bit player, even the Joker has some highlight moments, like forcing J'onn and Superman to go through a maze of his own making and later having J'onn temporarily restore some sense of order to the chaotic villain's psyche

-Both meta and regular human heroes get moments to shine and contribute

Cons

- The League's decision at the end doesn't make a whole lot of sense and feels hollow given that there are more issues to come.

-Darkseid is given some great dialogue, but doesn't have much else to do.

Overall

This was a strong collection that managed to provide great moments for both heroes and villain alike. It raises the stakes with a large scale story, but still manages to plant the seeds for something even bigger to come.

Click here to become an E-Poll member

Click here to become a Swagbucks member

Tuesday, July 14, 2020

'Let's Get It Right' - Flavor of the Week

Saturday, July 11, 2020

Brad Thor Bibliography: 'Path of the Assassin'

Thankfully, Thor's efforts to avert the trope paid off in spades, as this is a marked improvement over what came before.

The writing is stronger and tighter, the plot is more complex, and the stakes feel higher. Even the villains feel more capable. The Lions were a solid concept, but lacked in execution. Here, we see the titular assassin confront Harvath a few times and actually get the drop on him more than once. There's more tension as a result and it makes for a much more engaging read.

Harvath himself is also better depicted. He still butts heads with superiors, but the fact that they're from other departments helps. Sure, that's been done before too, but it still worked better. He's also more in line with how he is in the latter half of "Lions", where his schmuckish tendencies became more subdued. Really, the only scene where he came off as unlikable to me was when he accosted a CIA courier for no discernible reason. The biggest problem I had with him here was the fact that a lot of his smart-aleck remarks weren't particularly funny. He has a couple, but a lot of them fall flat; which is made worse by the fact that surrounding characters all react as if he's really pulling them off.

Harvath is joined by a new female compatriot. His partner/love interest from "Lions" is sent off to make way for her. Thankfully, while there is some flirtation/attraction, the two don't necessarily become a thing. The book does end with Harvath thinking that he intends to keep her in his life, but it's a bit more ambiguous. I think it works better this way. If Harvath is going to have a rotating cast of sidekicks, it's better that they don't all become love interests. It would get repetitive really quickly and harder to buy later on down the line.

There was a point where said character actually harbored a grudge against Scot and vowed never to trust him again. They make amends later, but a part of me actually wanted to see the two part on bad terms. It would have been an interesting subversion of the usual formula. Maybe that'll happen later, who knows?

Normally, I'd say just skip the first book and jump right to this one. Unfortunately, the plot of this one really does pick up where the first book left off. The events play a much bigger role in what happens here than I expected. In some ways, it's a good thing. The events of each book matter and there is a building continuity. On the other hand, I found "Lions" underwhelming, and having this be more self contained could have worked to its advantage as a stand alone thriller.

Still, this was a fun read. I think it does a much better job showing off Thor's talents as an author and I'm definitely more excited to progress through the series now than I was after the first book.

Click here to become a Swagbucks member

Sunday, July 5, 2020

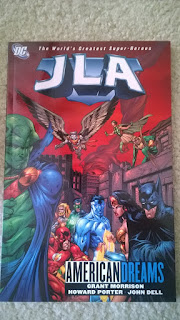

'JLA' Volume 2: 'American Dreams

Pros

- The Tomorrow Woman story arc is a simple, but poignant tale.

- The second story is rather large in scope, showing the forces of Heaven attempting to destroy Earth. It's a threat that puts even the combined might of the Justice League on their heels.

- Some interesting "elseworld" concepts are incorporated

Cons

- Rather than tell one story, this book contains several smaller stories. It makes for a more disjointed read.

- Said point also leads to pacing problems as the stories don't have as much room to develop as ones that span 6 or more issues.

Overall

If you're collecting the series in trade, this collects the next batch of issues. It's a short, fast read; however, the fact that it contains multiple stories makes it less immersive and results in even more pacing issues than its predecessor had. Still, the stories each have their own benefits, so it's worth checking out.

Friday, July 3, 2020

'Let's Get It Right' - Juice's Mock Draft 2.0

Wednesday, July 1, 2020

June 2020 Dividend Income: The Taxman Cometh

Speaking of two year anniversaries. This does mark two years of investing for me. It isn't quite as momentous as the first time around; though that could be due to this one being overshadowed by so many other things. In any event, let's do what we do and log the dividends for June.

Kroger (KR): $0.99 Up a penny from last quarter and up $0.15 from last year

SJW: $0.32 Same QoQ, YoY doesn't apply

AGNC: $0.14 Down $0.04 from last quarter and down $0.02 from last year. Both are due to dividend cuts.

CenturyLink (CTL): $0.28 Up a penny QoQ, Up $0.02 YoY. That's some mad growth right there.

Walgreen's Boots Alliance (WBA): $0.46 As this is a recent addition, there are no prior figures

Realty Income (O): $0.98 Up $0.25 QoQ, up $0.29 YoY. It was also up a penny from last month.

Wendy's (WEN): $0.36 down $0.50 from last quarter and down $0.34 from last year due to a recent cut

Flower's Foods (FLO): $1.04 Up $0.06 from last quarter and up $0.08 from last year

VF Corp (VFC): $0.49 Up a penny from last quarter with no YoY figure to compare

Bloomin Brands decided to sit this one out,which is understandable. Whether they resume their dividend payouts remains to be seen.

All in all, the total comes to $5.06, which is down $0.36 from last quarter, but up $1.45 from last year.

Considering there were a few cuts and a suspension, that number could have been a lot worse. The overall trajectory is still upward, which is reassuring.

Two funds within the 401K paid out this month. One paid $0.78 and the other paid $0.47. That total comes to $1.25, which is up $0.11 from last quarter and up $0.48 from last year.

That brings the grand total to $6.31. Up $0.79 from last quarter and up $1.93 from last year.

Interest payments clocked in at $3.73, which is up $0.47 from last month.

This month was pretty quiet on the buying front. I added two shares of Iron Mountain (IRM) and that's about it. The portfolio has been updated accordingly.

The effects of the slowdown are starting to kick in, which means hours were cut on both job fronts and, thus, less capital to deploy.

I've been upping my side hustle to try to make up the difference. I'm both going back and using already existing ones more frequently (I'm finally using my Swagbucks account for more than just the referral link!) and even browsed around for new ones. Interestingly, and perhaps concernedly, both DoorDash and Shipt are "fully staffed" in my area. It's a shame that AppTrailers went down. That was a decent one, but you play the cards you're dealt.

On the plus side, I got my taxes done. Unlike last year, where I owed, this time I did get a little something back (thank you traditional IRA contributions.) It wasn't a huge sum, but it was better than having to write a check, especially given the circumstances we face.

All in all, June was meh. There was modest growth, but it basically held steady. Again, it could have been worse, but seeing some more umph would have been nice. While I would like to see a second half rebound, I'm not sure how realistic it is. There's a part of me that is tempted to call 2020 a bust and focus on trying to set things up so that 2021 hits the ground running. Then again, if the first 6 months were any indication, we've got a long year ahead. Things can change, whether it is for the better or worse remains to be seen. All we can do is put our heads down and try to plow through.

"stock dividend" by CreditDebitPro is licensed under CC BY 2.0

Click here to become a Swagbucks member

Click here to begin your own investing journey on E-Trade

Click here to become an E-Poll member

Tuesday, June 30, 2020

'Let's Get It Right' - Reality vs. Perception

Monday, June 29, 2020

The Budget Surplus Amendment (Amended....Again)

Every so often, you'll hear about a balanced budget amendment, but at this point, I honestly don't think that goes far enough. We need a budget surplus amendment.

I propose that, for the next 40 years, the government's expenditures have to remain less than their revenues. It's a long time, sure, but this didn't happen over the course of one or two years; it makes sense that it would take a while to undo the damage.

So where would the surplus money go? I'm glad you asked because I've got a rough, but still pretty good, idea of how the capital should be allocated.

25% is to go towards debt repayment. This is a logical choice, as the debt itself is what brought this into being. In addition, bringing the debt balance down will reduce the amount of interest we pay over time. That means more capital. Besides, just think of how cool it would be to see that number moving down instead of rocketing upward as it has been for so long.

*Amended* 15% is to go towards unfunded liabilities. This is another figure that some bring up when it comes to the government's dismal fiscal situation. This isn't debt in a traditional sense, but it is money that the government is going to have to pay eventually, even though they don't have it. While this number isn't likely to ever "go away", getting it under control would still be to our collective benefit.

*Amended* 15% is to go towards universal income. It might not be the "basic" income number that has been making the rounds, but it is at least a start. Seeing as this was our money, it makes sense that we should get a portion of it back. From an economic standpoint, this has the same effect as a tax cut, only this can't push us back into deficit territory and it would work on a much wider scale.

15% would go towards universal HSA's (health savings accounts). Even before the pandemic, healthcare was a major issue. Some want more privatization, while others want to move to a single payer. This splits the difference and gives people a means of covering healthcare costs without any need for bureaucratic oversight, as each person would decide how to put their equal cut to use. You could use it to cover smaller, day to day medical costs, or allow it to accumulate and act as a medical emergency fund. It would do what people think single payer would do, only better. It's easier on the budget and, rather than take a bulldozer to the system, we apply spackle and fill in the cracks. Insurance plans, regular HSA's, and government plans would still be up and running; this would just operate along side it.

The last 10% would go towards an emergency/reserve/savings fund. It's abundantly clear that emergency funds are a good thing. This is true for individuals, for businesses, and for government. Imagine having money tucked away so that when something big did come up, we as a country would be ready for it and wouldn't have to scramble to get some plan together. Rather than constantly being on our back foot and frantically trying to figure out how things are going to get done, we'd have funds set aside to help carry us through. This may seem similar to the endowment, but they are two separate funds with two separate purposes. The endowment is there to generate income, where this is designed to be a pool to pull from when things turn South.

Now, this is all well and good, but how do we get there? The deficit is huge, so it will be no small feat inverting the curve. From a basic math standpoint, the logical answer would be to increase revenue and cut spending. The problem is that even when revenue was going up, spending never went down. Worse, most of the government's expenses are locked in. There aren't many places where they can cut. Even then, any suggestion is met with outrage from some group who advocates for it.

While I'm not averse to seeing the FICA taxed income limit increased (though I think that should be coupled with removing income restrictions on IRA's) or seeing the gas tax increased by one-tenth of a percent (I hate that fraction!) I think the best approach would be to do an end-run around the government. Politicians clearly have no interest in doing anything, so we should do it ourselves. A while back, I laid out some tools at our disposal that would strengthen social safety nets and shift the burden off the government (facilitating the much needed cuts) whilst simultaneously pumping more money into their coffers.

In addition, I think that the layout here motivates cuts. Why bother with bloated pork and wasteful spending when you can streamline and get much better results with surplus dollars?

Just think of how much stronger we'd be by the end of it. Individuals would have a much firmer foundation and the government would have hundreds of billions that was previously going towards interest to invest. It satisfies the conservative desire for fiscal responsibility while also achieving progressive goals. Who knows, while it might not be necessary after 40 years, the country could decide to keep it intact just because it works so well.

Will it happen? Probably not, but it's still a fun hypothetical.

Thursday, June 25, 2020

'Let's Get It Right' - Mock Draft 1.0

Sunday, June 21, 2020

'Let's Get It Right' - Back At It

Thursday, June 18, 2020

Cash is Ki

The Dave Ramsey fandom, for example, is fond of visual aids. They frequently use illustrated thermometers or game boards and color in portions to indicate their progress towards a savings goal or towards paying down a debt (even something as lofty as the mortgage on their house.)

The Dividend Diplomats came up with a game a while back where you calculate both your annual and hourly cost of living and use that to find out how much time your stock purchase paid for. These numbers can also be used to figure out how close you are to FI(RE).

Being a fan of DragonBall, it was only a matter of time before my brain provided another viewpoint by which to provide financial motivation. Said viewpoint was to compare it to something that the fans of the anime are all too familiar with, power levels.

In a way, that's what your net worth is, isn't it? It's your ability to face the various financial challenges that life provides. The more fiscal strength you have, the more you'll be able to pursue hobbies, support businesses, generate tax revenue, or give to charities. You could even view deploying capital in these fashions as very much akin to one of the franchise's many iconic beam attacks. First, you charge up your monetary energy via saving, than fire it at your target..

Now, one could use the comparison in a negative light and point to the gap between the 1% and the 99% being similar to Goku's and Vegeta's vast eclipsing of the rest of the cast. There is a difference, however. The two lead Saiyans do have the strictest training regiments of the cast, but one of the reasons they have skyrocketed the way they did was because of something called Zenkai, this is an innate biological ability where Saiyans get a power boost after recovering from injuries. Considering how many fights the pair get into over the course of the story, record growth is to be expected. They also benefit from the exponential growth that comes from the various transformations being power multipliers.

When it comes to finances, we have our own variations of these. There is compound interest/the dividend snowball where you start to make steadily increasing amounts of money off of your saved/invested money and a snowball effect starts to take place. I've seen some criticize this phenomenon, but that has always baffled me, as this is what you want to happen. It turns the process into a downhill battle, providing more motivation for you to get over the bumpy parts to the smoother waters ahead. Further more, everybody (yes, even you) can use it. It's math. Even if you are in a lower income bracket, you can still reap the benefits if you're committed and stick to a plan.

Our fiscal Zenkai would be acquired through investing in the market itself. Said market goes up and down depending on a myriad of factors. Sometimes (like now, for example) those swings can be large. If you keep a cool head and keep investing during the dips, you'll see your net worth increase much faster when the prices inevitably start to go back up, as you'll have acquired more shares when they were at a lower price.

Going back to the progress meters noted above, you could even use the "power levels" to indicate certain milestones. Mark a certain net worth as having hit "super saiyan" (maybe $100,000 as that first milestone is often cited as the hardest?) and go from there. You could always use something more official, but those later numbers are probably not too realistic. On the plus side, it does give you more milestones in the early portions, so it isn't without its upsides.

So, what do you think? Would this mindset result in more people going even further beyond and breaking their limits, or is it nerdy and eye-roll worthy?